Your Does paying property tax give ownership in the philippines images are available. Does paying property tax give ownership in the philippines are a topic that is being searched for and liked by netizens today. You can Get the Does paying property tax give ownership in the philippines files here. Find and Download all royalty-free photos and vectors.

If you’re searching for does paying property tax give ownership in the philippines images information connected with to the does paying property tax give ownership in the philippines topic, you have come to the right blog. Our website always provides you with hints for downloading the maximum quality video and picture content, please kindly search and find more informative video content and images that match your interests.

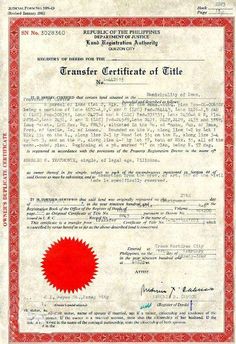

Does Paying Property Tax Give Ownership In The Philippines. Paying someone�s taxes does not give you claim or ownership interest in a property, unless it�s through a tax deed sale. The exact tax rates depend on the location of the property in the philippines. Along with the monthly payments for the loan taken out. The product of fair market value and by assessment level, which can charge a maximum of 20% to residential structures and 50% to industrial/commercial establishments.

Dzaka Ds Dzaka - Profile Pinterest From id.pinterest.com

Dzaka Ds Dzaka - Profile Pinterest From id.pinterest.com

If you are a resident, you are subject to income tax (including capital gains tax) and real estate tax (ibi). Chief justice artemio panganiban stated: Frequently asked questions about foreclosed properties in buying a foreclosed property, who pays for cgt, dst etc? You need to pay inheritance tax because you will inherit your husbands property. This is the republic act 4726 or the condominium act of the philippines which was mandated on june 18, 1966. Land ownership and property acquisition in the philippines for foreigners and former filipino citizens.

This means that paying taxes on a property you�re interested in buying won�t do you any good.

All property purchased while being married is conjugal. Even if only one’s name is declared by law it is conjugal so 50/50 ownership. In this article we will review all the. The product of fair market value and by assessment level, which can charge a maximum of 20% to residential structures and 50% to industrial/commercial establishments. Real property tax is a local tax and usually has to be paid at the local office, so this is one tax you might need to make a trip for. Now that he passed away you are the legitimate heirs of his 50% so you have to pay inheritance tax for the 50% inherited from hubby.

Source: pinterest.com

Source: pinterest.com

The only time taxes are typically paid for by someone else outside of a formal tax lien or tax deed sale is in efforts to keep the. Real estate tax is levied on philippine real property and the applicable rate varies depending on the location. This is the republic act 4726 or the condominium act of the philippines which was mandated on june 18, 1966. The real property tax rates in the philippines are discussed in section 233 of the local government code of 1991. Paying property taxes online some taxes in the philippines might need to be paid over the counter at an office, but it may be possible to pay others online.

Source: pinterest.com

Source: pinterest.com

Steam hose • 16 x 15 x 14 in • 9 pounds • 10 min heat up • 48 oz. The real property tax rate for metro manila, philippines is 2% of the assessed value of the property, while the provincial rate is 1%. All property purchased while being married is conjugal. Frequently asked questions about foreclosed properties in buying a foreclosed property, who pays for cgt, dst etc? In this post, i’ll discuss what else you need to know about real property tax.

Source: pinterest.com

Source: pinterest.com

Normally the seller is the one who shoulders cgt and dst is for the account of the buyer, but they can actually pass the cost of cgt to the buyer if they agree on such terms as part of the purchase. If the property is located in the province, tax must not exceed 50% of the 1% of the tax base stated above. Real estate tax in the philippines or simply real property tax (rpt) is a tax that you pay annually if you own a property. All property owners in spain are required to pay three different taxes each year. Most, if not all, states have statutes that provide that an occupant or user of real estate can obtain ownership rights to the property if they satisfy various requirements for up.

Source: id.pinterest.com

Source: id.pinterest.com

The tax rate varies depending on the location of the real property as presented below: Frequently asked questions about foreclosed properties in buying a foreclosed property, who pays for cgt, dst etc? In general, only filipino citizens and corporations or partnerships with least 60% of the shares are owned by filipinos are entitled to own or acquire land in the philippines. Paying property taxes online some taxes in the philippines might need to be paid over the counter at an office, but it may be possible to pay others online. In fact, in a way, it is just the beginning.

Source: pinterest.com

Source: pinterest.com

Normally the seller is the one who shoulders cgt and dst is for the account of the buyer, but they can actually pass the cost of cgt to the buyer if they agree on such terms as part of the purchase. “tax receipts and declarations are prima facie proofs of ownership or possession of the property for which such taxes have been paid. Most, if not all, states have statutes that provide that an occupant or user of real estate can obtain ownership rights to the property if they satisfy various requirements for up. Frequently asked questions about foreclosed properties in buying a foreclosed property, who pays for cgt, dst etc? In this post, i’ll discuss what else you need to know about real property tax.

Source: pinterest.com

Source: pinterest.com

Even if only one’s name is declared by law it is conjugal so 50/50 ownership. If you are a resident, you are subject to income tax (including capital gains tax) and real estate tax (ibi). The only time taxes are typically paid for by someone else outside of a formal tax lien or tax deed sale is in efforts to keep the. The cost of property ownership does not end at the purchase of real estate. Real property tax (rpt) is a tax that owners of real property need to pay every year so that the local government unit (lgu) will not auction off their property.

Source: pinterest.com

Source: pinterest.com

If the property is located in the province, tax must not exceed 50% of the 1% of the tax base stated above. It can also lead to your property being sold off by the government in part or as a whole. Most, if not all, states have statutes that provide that an occupant or user of real estate can obtain ownership rights to the property if they satisfy various requirements for up. All property purchased while being married is conjugal. All property owners in spain are required to pay three different taxes each year.

Source: pinterest.com

Source: pinterest.com

The tax rate varies depending on the location of the real property as presented below: By acquisitive prescription, possession in the concept of. Failing to pay your real property tax or amilyar not only leads hefty penalties; Along with the monthly payments for the loan taken out. Even if only one’s name is declared by law it is conjugal so 50/50 ownership.

Source: pinterest.com

Source: pinterest.com

In this article we will review all the. It can also lead to your property being sold off by the government in part or as a whole. The tax rate varies depending on the location of the real property as presented below: The real property tax rate for metro manila, philippines is 2% of the assessed value of the property, while the provincial rate is 1%. Even if only one’s name is declared by law it is conjugal so 50/50 ownership.

Source: pinterest.com

Source: pinterest.com

Land ownership and property acquisition in the philippines for foreigners and former filipino citizens. Does paying property tax give ownership? The only time taxes are typically paid for by someone else outside of a formal tax lien or tax deed sale is in efforts to keep the. Chief justice artemio panganiban stated: Along with the monthly payments for the loan taken out.

Source: pinterest.com

Source: pinterest.com

If the property is located in the province, tax must not exceed 50% of the 1% of the tax base stated above. Even if only one’s name is declared by law it is conjugal so 50/50 ownership. Paying property taxes online some taxes in the philippines might need to be paid over the counter at an office, but it may be possible to pay others online. In this post, i’ll discuss what else you need to know about real property tax. Rpt is a way to increase funding for the lgu for it provide basic public services.

Source: pinterest.com

Source: pinterest.com

Real estate tax is levied on philippine real property and the applicable rate varies depending on the location. In this article we will review all the. The tax rate varies depending on the location of the real property as presented below: Frequently asked questions about foreclosed properties in buying a foreclosed property, who pays for cgt, dst etc? The cost of property ownership does not end at the purchase of real estate.

Source: pinterest.com

Source: pinterest.com

Paying property taxes online some taxes in the philippines might need to be paid over the counter at an office, but it may be possible to pay others online. The real property tax rates in the philippines are discussed in section 233 of the local government code of 1991. All property owners in spain are required to pay three different taxes each year. The tax rate varies depending on the location of the real property as presented below: In general, only filipino citizens and corporations or partnerships with least 60% of the shares are owned by filipinos are entitled to own or acquire land in the philippines.

Source: pinterest.com

Source: pinterest.com

In this post, i’ll discuss what else you need to know about real property tax. Land ownership and property acquisition in the philippines for foreigners and former filipino citizens. Additional tax rates will apply to your properties on. Paying someone�s taxes does not give you claim or ownership interest in a property, unless it�s through a tax deed sale. The cost of property ownership does not end at the purchase of real estate.

Source: pinterest.com

Source: pinterest.com

The only time taxes are typically paid for by someone else outside of a formal tax lien or tax deed sale is in efforts to keep the. Additional tax rates will apply to your properties on. The only time taxes are typically paid for by someone else outside of a formal tax lien or tax deed sale is in efforts to keep the. In this article we will review all the. The product of fair market value and by assessment level, which can charge a maximum of 20% to residential structures and 50% to industrial/commercial establishments.

Source: pinterest.com

Source: pinterest.com

Paying someone�s taxes does not give you claim or ownership interest in a property, unless it�s through a tax deed sale. Transfer tax is the tax imposed on any mode of conveying the ownership of a real property, either through sale, donation, barter, or any other mode. The only time taxes are typically paid for by someone else outside of a formal tax lien or tax deed sale is in efforts to keep the. In fact, in a way, it is just the beginning. This means that paying taxes on a property you�re interested in buying won�t do you any good.

Source: pinterest.com

Source: pinterest.com

Coupled with proof of actual possession of the property, they may become the basis of a claim for ownership. Now that he passed away you are the legitimate heirs of his 50% so you have to pay inheritance tax for the 50% inherited from hubby. Generally, the payment of real estate taxes alone is never sufficient to give the taxpayer ownership rights to a property. If the property is located in the province, tax must not exceed 50% of the 1% of the tax base stated above. The cost of property ownership does not end at the purchase of real estate.

Source: pinterest.com

Source: pinterest.com

In general, only filipino citizens and corporations or partnerships with least 60% of the shares are owned by filipinos are entitled to own or acquire land in the philippines. Normally the seller is the one who shoulders cgt and dst is for the account of the buyer, but they can actually pass the cost of cgt to the buyer if they agree on such terms as part of the purchase. This is the republic act 4726 or the condominium act of the philippines which was mandated on june 18, 1966. Paying property taxes online some taxes in the philippines might need to be paid over the counter at an office, but it may be possible to pay others online. Transfer tax is the tax imposed on any mode of conveying the ownership of a real property, either through sale, donation, barter, or any other mode.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title does paying property tax give ownership in the philippines by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.