Your California vpdi tax rate images are ready in this website. California vpdi tax rate are a topic that is being searched for and liked by netizens now. You can Find and Download the California vpdi tax rate files here. Download all free images.

If you’re looking for california vpdi tax rate images information linked to the california vpdi tax rate topic, you have come to the right site. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

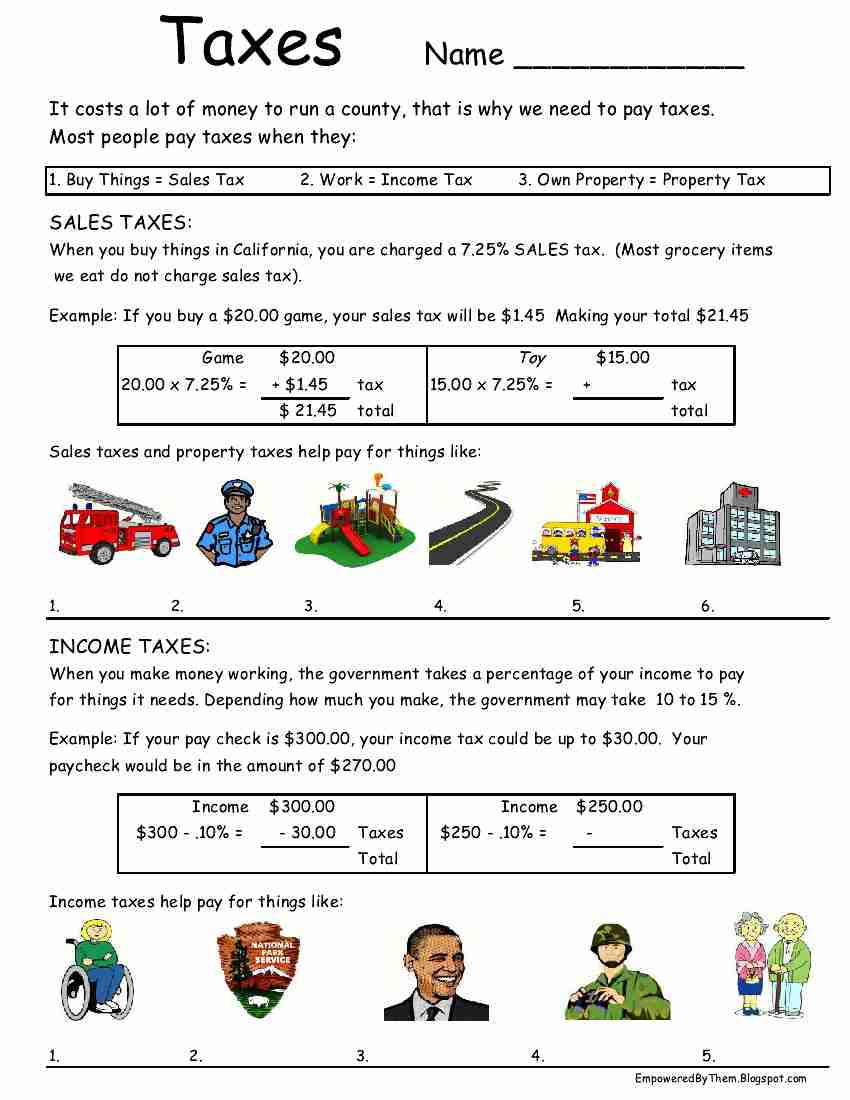

California Vpdi Tax Rate. Voluntary plan group, mic 29vp. Fill in the cir cle if from: Do not enter the same amount in both fields. One of a suite of free online calculators provided by the team at icalculator™.

Pzncfanpvgeb5m From

Pzncfanpvgeb5m From

If one employer took out more you have to get it back from the employer. State disability insurance (sdi) tax sdi is a deduction from employees� wages. Ca vpdi is “voluntary plan for disability. Generally, vpdi contributions are not considered tax deductible on your federal tax return. Sounds like you received benefits under your vpdi program, not pfl benefits. 2020 voluntary plan employee contribution and benefit rate.

However, some individuals can take a credit if they meet the following conditions:

If there is excess withheld, it will flow to line 74 of. 010) of sdi taxable wages per. The sdi taxable wage limit is $118,371 per employee for calendar year 2019. The maximum sdi withholding tax for 2017 is $998.19 ($110,902 x.90%). Just to be clear, vpdi is a private insurance program, unlike pfl which is a state program. You may be entitled to claim a credit for excess sdi (or vpdi) only if you meet all of the following conditions:

Source: pinterest.com

Source: pinterest.com

Sounds like you received benefits under your vpdi program, not pfl benefits. You had two or more employers during 2017. Voluntary plan group, mic 29vp. So enter the max for box 14 on that w2. The cost to the employee for a vpdi plan is the same or less than the state sdi plan (1% of wages).

Source: nl.pinterest.com

Source: nl.pinterest.com

Available for pc, ios and android. Likewise, what is california voluntary disability tax? The sdi taxable wage limit is $118,371 per employee for calendar year 2019. 2020 voluntary plan employee contribution and benefit rate. The rate is determined by the length of time the employer has been in business, the employer�s industry and the amount of former employees who have claimed benefits on the employer�s account.

Source: pinterest.com

Source: pinterest.com

If one employer took out more you have to get it back from the employer. For example, assuming the 2011 sdi tax rate of 1.2 percent, or 0.0120, an employee who receives $1,000 wages in 2011 would be subject to $12 sdi tax (1000 x 1.0120 = 1,012). However, some individuals can take a credit if they meet the following conditions: Multiply the total taxable wages by the current sdi tax rate. Available for pc, ios and android.

Source: pinterest.com

Source: pinterest.com

T ax t able t ax rate schedule. 2020 california tax tables with 2021 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. Voluntary plan for disability insurance. California sui tax rate employers pay state unemployment insurance at their designated annual rate, up to the yearly wage limit. Fill in the cir cle if from:

Source: pinterest.com

Source: pinterest.com

If you didn’t get to deduct the amounts you paid into the program, then that would be taken into account when you receive. This figure is the product obtained by multiplying the worker contribution rate by 14% or 1.2% x 14% = 0.168% per cuic 3252 (b) 0.168%. So enter the max for box 14 on that w2. State disability insurance (sdi) tax sdi is a deduction from employees� wages. Do not enter the same amount in both fields.

Source: pinterest.com

Source: pinterest.com

You received more than $118,371 in wages in calendar year 2019. There are effectively 0, 15, 18.8, and 23.3 brackets for long term capital gains at the federal level. One of a suite of free online calculators provided by the team at icalculator™. Voluntary plan for disability insurance. Voluntary plan group, mic 29vp.

Source: pinterest.com

Source: pinterest.com

Likewise, what is california voluntary disability tax? You had two or more california employers. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower. Maximum weekly benefit amount (wba) $1,357. Fill in the cir cle if from:

Source: pinterest.com

Source: pinterest.com

You may be entitled to claim a credit for excess sdi (or vpdi) only if you meet all of the following conditions: Multiply the total taxable wages by the current sdi tax rate. One of a suite of free online calculators provided by the team at icalculator™. You received more than $118,371 in wages in calendar year 2019. Voluntary plan group, mic 29vp.

Source: pinterest.com

Source: pinterest.com

To find your sales and use tax rate, please go to the california department of tax and fee administration’s website at cdtfa.ca.gov and type “city and county sales and use tax rates” in the search bar. However, some individuals can take a credit if they meet the following conditions: The sdi taxable wage limit is $118,371 per employee for calendar year 2019. Maximum benefit amount (wba x 52 weeks) $70,564. So enter the max for box 14 on that w2.

Source: pinterest.com

Source: pinterest.com

If there is excess withheld, it will flow to line 74 of. Generally, vpdi contributions are not considered tax deductible on your federal tax return. 2020 voluntary plan employee contribution and benefit rate. Maximum benefit amount (wba x 52 weeks) $70,564. Voluntary plan group, mic 29vp.

Source: pinterest.com

Source: pinterest.com

Employers withhold a percentage for sdi on the first $122,909 in wages paid to each employee in a calendar year. The sdi taxable wage limit is $118,371 per employee for calendar year 2019. The maximum sdi withholding tax for 2017 is $998.19 ($110,902 x.90%). As a result of the ratio of the california ui trust fund and the total wages paid by all employers continuing to fall below 0.6%, the 2021 sui tax rates continue to include a 15% surcharge. Likewise, what is california voluntary disability tax?

Source:

Source:

There are effectively 0, 15, 18.8, and 23.3 brackets for long term capital gains at the federal level. If there is excess withheld, it will flow to line 74 of. Yes, it is a required deduction. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower. Voluntary plan for disability insurance.

Source: pinterest.com

Source: pinterest.com

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower. The new employer sui tax rate remains at 3.4% for 2021. Yes, it is a required deduction. Available for pc, ios and android. To find your sales and use tax rate, please go to the california department of tax and fee administration’s website at cdtfa.ca.gov and type “city and county sales and use tax rates” in the search bar.

Source: pinterest.com

Source: pinterest.com

You received more than $110,902 in wages. If there is excess withheld, it will flow to line 74 of. So enter the max for box 14 on that w2. The maximum sdi withholding tax for 2017 is $998.19 ($110,902 x.90%). As a result of the ratio of the california ui trust fund and the total wages paid by all employers continuing to fall below 0.6%, the 2021 sui tax rates continue to include a 15% surcharge.

Source: pinterest.com

Source: pinterest.com

Generally, vpdi contributions are not considered tax deductible on your federal tax return. Just to be clear, vpdi is a private insurance program, unlike pfl which is a state program. Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower. Voluntary plan for disability insurance. The california franchise tax board (ftb) offers tips on the most common audit issues found on the personal income tax returns of state residents.

Source: pinterest.com

Source: pinterest.com

The cost to the employee for a vpdi plan is the same or less than the state sdi plan (1% of wages). Voluntary plan for disability insurance (vpdi) is not deductible on the federal tax return (schedule a) per rev. If there is excess withheld, it will flow to line 74 of. Do not enter the same amount in both fields. 2020 voluntary plan employee contribution and benefit rate.

Source: pinterest.com

Source: pinterest.com

Likewise, what does vpdi mean? Sounds like you received benefits under your vpdi program, not pfl benefits. The maximum to withhold for each employee is $1,183.71. Maximum benefit amount (wba x 52 weeks) $70,564. The sdi taxable wage limit is $118,371 per employee for calendar year 2019.

Source: pinterest.com

Source: pinterest.com

Just to be clear, vpdi is a private insurance program, unlike pfl which is a state program. The maximum sdi withholding tax for 2017 is $998.19 ($110,902 x.90%). You had two or more employers during 2017. In any event, the tax treatment should be similar. Amounts entered in these fields with a postal code of ca transfer to federal schedule a, line 5 and also to the california excess sdi/vpdi withholding worksheet.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title california vpdi tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.